Skylytix Capital

YOUR LOAN APPROVAL STARTS HERE Tailored Solution Fast Approval Credit Repair Clear Guidence Real Results Trusted Support

Loan process made simple, clear and fuss-free We work with banks and financial institutions to get you the right loan, guiding you from credit improvement to disbursement.

Stressed about Cashflow?

Focus on what you do best and grow your business with confidence. We will handle the financing and find the right solution for you.

Running Low on Funds?

Tell us your situation and we will advise you on the financing options that fit. There is always a way forward and a solution that can work for you.

Overwhelmed by Old Business Debt

When multiple loans start piling up, it becomes hard to breathe. We can restructure or refinance your existing debt into a more manageable plan, giving you space to recover and grow again.

About Us

Why Apply Through Skylytix Capital

Skylytix Capital was built on a simple idea: people deserve clearer paths to funding. Whether you’re running a growing business or managing personal finances, we guide you through the entire loan process with practical advice, transparent steps, and options that actually fit your situation.

What this really means is you get a partner who understands the local lending landscape, speaks the same language as banks and private lenders, and fights for the terms that make sense for you.

To match you with the right loan, guide you through the process and negotiate with banks to get you the best results.

Our Services

Choose the Financing that

fits your needs best

Business Loan Consulting

Running a company is already a challenge; financing shouldn’t make it harder. We help SMEs secure working capital loans, expansion loans, equipment financing, invoice financing, and more. We review your business profile, shortlist lenders, and position your application the way decision-makers expect.

Personal Loan Consulting

If you need funds for emergencies, debt consolidation, or a big-ticket purchase, we connect you with suitable licensed lenders and guide you on the best approach. You stay in control, with a clear breakdown of interest rates, repayment plans, and what each option means long term.

SME Working Capital Loans

Cash flow shouldn’t slow your growth. We help you access government-backed schemes and private-sector financing designed for Singapore SMEs.

Startup Funding Guidance

Early-stage businesses often struggle with documentation and eligibility. We help you understand realistic options and structure your application to improve approval chances.

Loan Comparison & Advisory

Every lender has different requirements. We compare offers, explain the differences in plain language, and help you choose the smartest route forward.

Common Issues

Inflating Credit Card Debt

Owe over $5K? We’ll combine your credit cards into one loan with better terms so you can breathe easier.

Bank Rejections

Tired of getting rejected with no explanation? We find out what went wrong and help you fix it. Then we build your profile so banks see you as a top customer they want to lend to.

Jane was rejected by two banks with no clear reason. We found the issues, fixed them, and helped her get approved fast.

Low Credit Score

We’re the only team in Singapore that offers full CBS repair support. If your credit rating is holding you back, we’ll help rebuild it so you can finally qualify for real approvals.

A client initially had a HH rating and had been rejected by multiple banks. With a customised recovery plan, his score improved to BB quickly. He was finally able to secure the funding he needed.

Drowning in Bills

One client had over 45000 in outstanding bills including hospital fees, rent, and car repairs. We stepped in quickly, assessed the situation, and secured the funds to bring everything back under control.

Own a private property?

Are You Eligible Personal Finance?

Criteria for a Personal Financing according to Banks

Singaporean/PR

21+ years old

Minimum Annual Income: $20,000

Foreigner (Valid Work Pass)

21+ years old

Minimum Annual Income: $45,000

Malaysian (Work Permit)

21+ years old

Basic monthly salary: $2500

Documents Required

- Credit Bureau Report (Official Credit Report)

- Notice of Assessment (Total Income for 2026 & 2025)

Not sure how to get these documents? Don’t worry, we’ll guide you step-by-step.

Are You Eligible for Business Financing?

Criteria for a Business Financing according to Banks

- Director is Singaporean/PR

- Acra Registered

- In-Corporation date >1 Year

Don’t meet the banks’ criteria? Talk to us. We’ll assess your situation and recommend the best alternative financing options available.

Documents Required

- Director's Credit Bureau Report (Official Credit Report)

- Notice of Assessment (Total Income for 2025 & 2024)

- Latest 6 Month (Individual Months) Company Bank Statements

Not sure how to get these documents? Don’t worry, we’ll guide you step-by-step.

HOW IT WORKS

Your Roadmap to Smarter Financing

Here's how we help you get the financing you need, simplified into three easy steps.

01.

We assess your financial standing — including repayment ability and debt-to-income ratio — to ensure we recommend only the loans you actually qualify for and can manage with confidence.

02.

✅ Loan Approved

We guide you on how to draw down your loan with the best tenure and interest so that it works smartly for you.

❌ Loan Rejected

We guide you on how to draw down your loan with the best tenure and interest so that it works smartly for you.

03.

Approval is just the beginning. We help you make the most of your funds with repayment planning, credit repair guidance, and future loan strategy support.

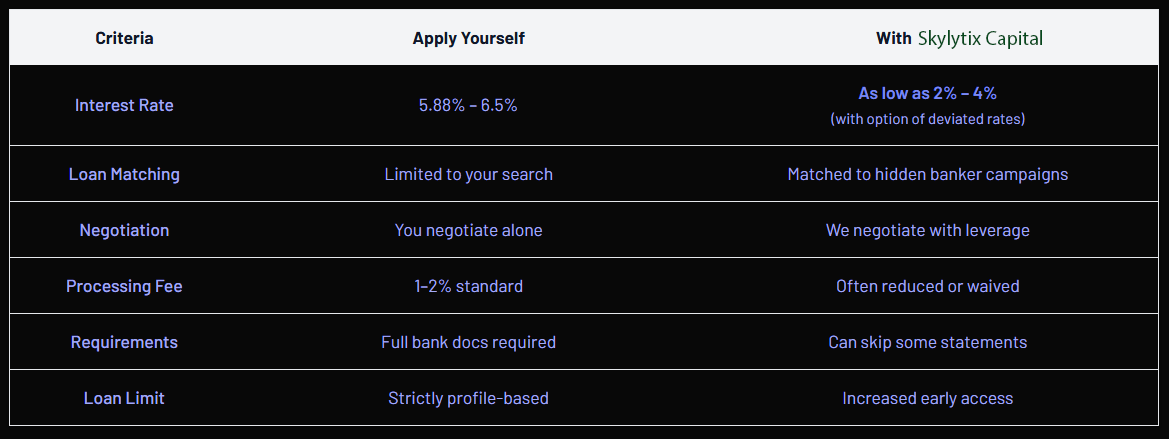

Don’t leave your loan outcome to chance. We negotiate behind the scenes, unlock hidden rates, and

give you an edge you won’t get applying on your own.

What You Don't Know Might Cost You More

We check internal bank scores before applying

Enjoy waived fees, lower rates, and less red tape

Get matched to better loan campaigns instantly

We talk to real bankers—not just online forms

Beyond Funding: Real Growth Support For Businesses

At Skylytix Capital, we don’t just help you secure financing, we actively help you grow your business.

We offer professional business support services to boost your visibility, traffic, and sales:

- Website Development that turns visitors into customers

- Digital Marketing across FB, IG, Google, or LinkedIn, designed to drive leads and engagement

- Expert Advice backed by our broad network and hands-on industry experience

A retail client saw a 3× increase in sales after we redesigned their website and launched their first Facebook ad campaign.

Know someone who needs funding?

Refer them to Skylytix Capital and enjoy rewards, perks, and priority access to exclusive benefits. Our referral program is straightforward, flexible, and designed to thank you for connecting us with those who need our help.

- Business owners

- Law firms

- Interior designers

- Banking professionals

- Property agents

- Book-keeping firms

- Car dealers

- SME loan brokers

- Insurance agents

- Entrepreneurs

Our Testimonials

Experience financial growth with us

Touch WIth Us

One Step Closer to Getting Funded

Email Address :

Sky@trusta.com.sg

Phone Number :

(+65) 8559 4085

Address:

1 Commonwealth Ln, #06-12/13/25/26,

Singapore 149544